Navigating Through the Corporate Transparency Act: A Guide for Business Owners

Navigating Through the Corporate Transparency Act: A Guide for Business Owners

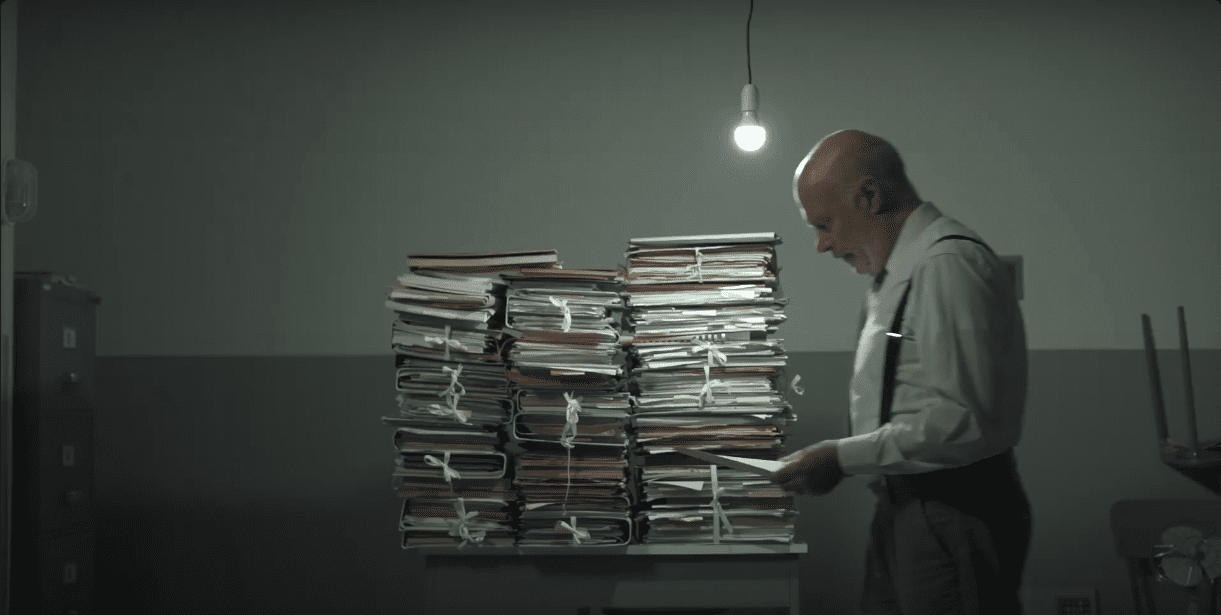

In today’s business landscape, compliance is no longer a luxury—it’s a necessity. The Corporate Transparency Act (CTA) has sent ripples through the business world, creating both confusion and urgency. Are you prepared to meet its requirements? More importantly, do you understand what’s at stake if you don’t? Let’s unravel the complexities of the CTA, providing clarity, solutions, and peace of mind for business owners.

What is the Corporate Transparency Act and Why Does It Matter?

The Corporate Transparency Act is more than just another piece of legislation; it’s a game-changer for businesses of all sizes. Passed to combat financial crimes like money laundering and fraud, the CTA mandates stricter reporting requirements for companies. But why does this matter to you?

Under the CTA, businesses must disclose specific ownership and management details to the Financial Crimes Enforcement Network (FinCEN). This means identifying your “beneficial owners”—individuals who have significant control over or a large stake in your company. Failure to comply isn’t just a slap on the wrist; penalties include steep fines and potential criminal charges.

As one business owner put it: “Compliance isn’t optional. It’s the foundation of trust in the financial ecosystem.”

Who Needs to Comply with the CTA?

Think the CTA doesn’t apply to your business? Think again.

The law casts a wide net, covering corporations, limited liability companies (LLCs), and other similar entities. Some exemptions exist, such as for larger companies with substantial revenue and workforce, but the majority of small and medium-sized businesses must comply.

Here’s a breakdown:

- Businesses Formed in the U.S.: Any corporation or LLC created in the United States falls under this law.

- Foreign Companies Doing Business in the U.S.: If your business operates within the U.S., you’re likely required to report.

- Nonprofit Organizations: Certain nonprofits may also need to meet these requirements, depending on their structure and activities.

Question for reflection: Do you have the infrastructure to accurately track and report this information?

Steps to Achieve CTA Compliance

Feeling overwhelmed? Don’t worry—you’re not alone. Here’s a step-by-step guide to simplify your compliance journey:

1. Identify Beneficial Owners

This is the cornerstone of CTA compliance. Beneficial owners are individuals who:

- Own 25% or more of the company.

- Exercise significant control over the company.

Gather their names, dates of birth, addresses, and government-issued IDs.

2. Maintain Accurate Records

Think of this as your company’s financial footprint. Organize your ownership structure and keep it updated. Digital tools like compliance software can streamline this process.

3. File Reports with FinCEN

Reports must be filed at the time of formation and updated annually. This step ensures your business remains transparent and compliant.

4. Implement Internal Compliance Policies

Educate your team about CTA requirements and create a system for monitoring changes in ownership or management.

5. Consult Professionals

Navigating this terrain alone can be daunting. Hiring a compliance consultant or legal expert can save you time, money, and stress.

“Compliance isn’t about ticking boxes,” says compliance expert Lisa Grant. “It’s about building credibility and safeguarding your business.”

The Risks of Non-Compliance

What happens if you fail to comply? The answer is simple: consequences that can cripple your business. Non-compliance can result in:

- Fines: Up to $500 per day for failure to report.

- Criminal Penalties: Severe cases may lead to imprisonment.

- Damaged Reputation: In today’s transparent world, reputational damage can be harder to recover from than financial penalties.

Think of compliance as insurance—something you invest in now to avoid catastrophic losses later.

How the CTA Strengthens Your Business

While the CTA might feel like a burden, it’s also an opportunity. Compliance shows that your business is legitimate, trustworthy, and prepared for the future.

Building Trust

Customers, investors, and partners prefer companies with a transparent structure. Compliance sends a clear message: you have nothing to hide.

Streamlining Operations

The CTA encourages better record-keeping and operational clarity. These practices can help you identify inefficiencies and improve your overall business strategy.

Your Next Steps: Navigating CTA Compliance with Confidence

So, where do you go from here? First, acknowledge the importance of compliance. Second, act quickly—delays can lead to complications. Finally, leverage expert guidance to navigate these requirements efficiently.

Need help? Our team specializes in helping businesses achieve CTA compliance with minimal hassle. For a limited time, we’re offering a free compliance checklist to ensure you’re on the right track. Don’t let the Corporate Transparency Act catch you off guard—let us guide you to success.

Conclusion: Turning Challenges into Opportunities

The Corporate Transparency Act may feel like an uphill battle, but with the right approach, it can become a stepping stone to greater credibility and success. Have you identified your beneficial owners? Are your records up to date? These questions aren’t just for reflection—they’re a call to action.

Compliance isn’t just about avoiding penalties; it’s about positioning your business as a trusted leader in your industry. Embrace the challenge, take control, and secure your company’s future. After all, transparency isn’t just a requirement—it’s your competitive edge.